Fellowship of the Wrong

Buy on Amazon UK £9.99 and other regions, Super Saving free shipping.

As the financial crisis fastens its grip ever tighter around the means of human and natural survival, the age of the algorithm has hit full stride. This phase-shift has been a long time coming of course, and was undoubtedly as much a cause of the crisis as its effect, with self-propelling algorithmic power replacing human labour and judgement and creating event fields far below the threshold of human perception and responsiveness.

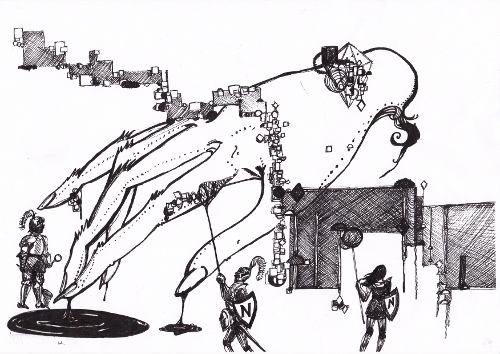

Is the age of accelerationist finance and High Frequency Trading really a kind of science fiction, or is it more like (digitalised) Tolkien? Benedict Seymour offers a Marxist-Tolkienist satire of algorithmic reaction, humanist bourgeoisdom, and expanding non-reproduction. Illustrations by Rona Tunnadine

\document class: {saga}

\begin {document}

\begin {algorithm}

Part 1 – An Unexpected Journey into High Frequency Trading

A plague of Orcs is haunting Middle-Class. The people of Wall Shire are scared. Hard working finance hobbits and their families are being put out of business. All the powers of Market have entered into a 6-part franchise to exercise this spectrum of High Frequency Trading.

The Orcs are as ubiquitous as they are obscure. Most human folk do not even know that they exist, yet they dominate the financial markets, in particular Equities – the trading of stocks and shares. Their brother goblins, known to us as ‘bots’, are rife throughout the Great Net and have infested all the lands of Middle-Class from Amon Zon (Elvish for shopping), to Númenor (personal loans), and across the whole domain of Fangbook and Twii-dûr (social networking).

The human words for ‘Orc’ derive from the mathematical term, ‘algorithm’ – so the feral horde are known to finance folk as algos, algobots, or bots. In the eyes of science they are no more than algorithmic programs that run on computers and carry out repetitive lists of instructions. The Orcish bot is simply a complex equation expressed in lines of code, a set of commands by which the bots can get at the price of traded assets, buying and selling them on the market servers of the NYSE and NASDAQ. But because the Orc bots are so swift in their computing, they can find profits where no human trader could. The Orcs exists within a different temporal and spatial dimension, using speed to create and make money out of the smallest imaginable differentials in price. They produce the conditions which they then exploit, churning up the price of everything to wring out incrementally accruing returns. The bots are pound wise because, not in spite, of their penny-mania. Accumulating fractions of a cent over the course of a day as they zoom in and out of short term positions, they squeeze a fortune out of a ‘long tail’ of microscopic trades.

Consider the contrast with human trade, in which the trader invests in the shares of productive companies, seeking to make a profit by the rise or fall of firms and their products. In the process, the goodly go-betweens create jobs and useful commodities for all. Not so the Orcish bots – they move too fast to think about the final ends of trade. They hold positions for mere seconds or milliseconds, rushing in and out of shares and bonds, not caring if the human business on which they feed survives or fails. Some say they are a boon, bringing price discovery and liquidity to the parched markets, making trading cheaper, faster, more open to the humble hobbit. But while they help establish the prices of and market for stocks, providing a permanent supply of avid buyers and sellers, their speed conceals as much as it reveals. Their price revelations cause values to fluctuate with ever greater volatility. For the bots are febrile creatures, they feed on the difference between prices, exploiting sudden changes in the status of companies and the shifting behaviour of the market itself. Bots feed on bots in a spiral of feedback. They can make a market or ravage a company like a plague of locusts descending all at once on a single field. They make trading happen by providing a flock of potential buyers and sellers, but when the bots disperse, taking liquidity with them, they leave the market dry as a desert. No wonder human traders are petrified.

The invasion began around the time of the Great Crisis. As volatility increased in markets primed with fear and sovereign debt, the Orc bots stormed the citadel. Imperceptible at first, they battened on the trade in stocks and bonds, pestering and pummelling the markets’ honest burghers. They demanded prices, prices, prices – but then would fail to buy, or buy then sell again, over and over. At once ruthlessly focused and hopelessly dim, they’d all rush in one direction, then turn around and rush back, rampaging through the market like a mob of zombies. Rapt in a recursive loop, the Orc bots would spend hours at a time soliciting quotes from a single company, reacting to shifts in market perception they themselves created. Feral window shoppers entranced by their own reflection. City hobgoblins.

All images by Rona Tunnadine

Algorithms accelerate the process of assessment, indeed they teeter on the brink of suspending it entirely. As the Orcs swarmed into the domain of human judgement they risked its annihilation. They defile the realm of abstraction, shake the frame of equivalence to pieces and throw it back together, ever so slightly out. Human traders were confused, alternately concerned and contemptuous, as if industrial workers had suddenly stormed the trading pit, the pure realm of speculation, knocking through the division of head and hand. The bots extend the dull propulsion of the machine to the highest spheres of financial reason. But many humans were only too eager to trade with them, if only because they seemed to reanimate the market. The Orcs created a simulacrum of activity to fill the post-crunch void, an imitation of a thriving economy for a world facing the chronic contraction of wealth. Some say it was the exotic financial instruments – derivatives, CDS and CDOs – that came before them, the toxic SIVs, swart swaps, and other spawn of VAR, that battered down the Chinese walls of finance and blazed a trail for the Orcish rout. It was these dastardly meta-contracts, models and money-like claims, still primitive and analogue in many ways, that cracked open the Vale of Exchange and made a way for Orcish ruin. The darkling bots were just the latest in a train of raiders, wonky equivalents and crooked complexities by means of which the rich and corrupt elders of Middle-Class hoped to go on cheating their destiny, deferring the disaster they themselves had unleashed. But could these human masters really command their new ‘helpers’? Were they not instead become the plaything of the Orcs – or some darker purpose of which the bots were but the front end?

Thousands of times a second the bots would make their enquiries, buy, sell, or simply move on to their next mark. The automated traders could beat any human merchant to the quote, transacting in the blink of an eye. Soon, professional human merchants, with no ambition but to husband the modest fortunes in their care, were losing out to the Orcish onslaught. Honest dealers had to admit defeat, outdone by a spectral competitor, broken by a mere machine. Some grew angry and cried out for Ned Ludd to come and dole out justice to these robot interlopers. Former fund managers, who knew only the simple toil of productive investment, with narry a speculative bubble nor asset stripping operation to their name, found themselves suddenly obsolete, flung on the heap by a plague of anonymous bots.

Within a few frantic months the Orcs had grown to outnumber humans in the electronic pits. Soon they swarmed so thick and fast the very market seized. The first crash was so fast it was almost subliminal, but for a few tense moments billions were wiped from the value of shares, vast corporations teetered on the brink. Who knew what would happen next? – the riotous bots were out of control, human capitalists felt a shiver of fear.

The people of Wall Shire had not worried much when the bots first appeared. Many credulous and avaricious hobbits adopted them to execute their trades and sought to gain by the Oricsh algos’ speed. But when the Flash Crash came the good people of Middle-Class began to pay attention. The citizens of Wall Shire discussed and debated the Orc invasion, wondering if and when the markets would go down again. But others said the bots were plague enough in any case, and must be reined in or run out of town. The bots ate up the time and space of trade like a plague of locusts. Infesting and devouring the exchanges where they thrived, some said they were slowly driving out good trades with false and bad, like a flood of spam drowning an inbox. Just hosting these voracious hordes was costing the yeoman data farmers ever more of their hard earned loot.

And now the algos’ dominion is expanding, ever-bigger servers must be constructed to accommodate the teeming, quote seeking plague. Vast towers, tunnels, and complexes are built to host these unproductive bots. And all because, their human masters (but are they masters, or merely puppets?) claim they make it easier and quicker to do business.

The Orcish bots, or so the Tylers of Durden claim, are little more than an occupying army. They colonise the servers and make the markets do the work of Sour Ron – the Dark Lord of Code. If the Legend be true, Sour Ron is a disgruntled über-geek gone over to the side of darkness. Sour Ron sees everything with a single eye the size of Fangbook and Twii-dûr combined. His black agents, faster than thought seethe within the very substance of the Value Crystal – the true source of the physical world, or so the Old Songs tell.

The whisper goes about that Sour Ron means to return, and when all the human fund managers are gone, picked off by his murderous, microsecond legions of code, he will take over the market. The first great convulsion – the Flash Crash of 2.45 – was just a warning of what is to come. The Orcish bots go on bombarding the exchanges with millions of quote requests a day, yet the volume of actual transactions remains the same, even falls. For nano-seconds the bot assault slows down the network, causing a ‘brown out’ of the market, and they steal by this momentary stasis an advantage over their ugly brother bots. Using speed to bring sclerosis to the very frame of trade, they gouge a profit from the form of Exchange itself. They shake it to a halt, spamming honest burghers till the market’s quote-stuffed maw coughs up an instant’s leverage. They smash and grab, loot then riot on.

Each trading day as the market stops to draw a shattered breath, the Orc bots disperse, rushing back into the shadows leaving nought but a trail of phosphorescent square and saw-tooth trading graphs behind them – the only clue as to their brutal logic. The Knights of Nanex – a group of noble men skilled in the ways of data but sworn to defend human trading – set nets to catch the bots then scry their lurid entrails. Using the tools of their craft the Knights plot and parse the algo code, teasing out the method in their madness. They sift the static of these headless raiders, throw their shapes onto the screen, pinning up the ultra-fast and invisible like butterflies, luminous hoodlums. But all they can do is infer the hidden hand of human coders behind the algorithmic rages, guess at the mortal greed and strategy that makes humans turn the market’s tools against the terms of trade itself. Peering into the darkness they fear to glimpse the bigger picture – the more than human madness here – but they sense it, that ‘something’ more vast and abstract, more sublime and more unspeakable, than the bots themselves. Something there is within the very market that threatens to overwhelm its reason, or its reason to be.

No one knows whom the Orc bots really serve, as their human – some say semi-human – ‘controllers’, the High Frequency men, lurk at the bottom of Dark Pools and never see the light of day. Spurning the honest guilds and lavish websites of market-fearing folk, they hide behind single page portals and conduct their dealings with the Orcs furtively. Their trades are secret, coded and recoded by The Internalisers, creatures of the interstices who turn every transaction into a Black Box, hidden from the sight of God. The bots surge on, server space is no sooner expanded than the bots guzzle it up again, glutting on the margins then disgorging themselves at the close of trade. Visible to none but Sour Ron with his all-seeing-eye, the bots grow ever quicker, racing toward light speed like an errant neutrino – perhaps beyond. Rumour expands to fill the void of knowledge. Sour Ron, they whisper, intends to break the laws of physics or bend them to his will – or so it is written in the blogs – to breach the rule of space-time itself. The dark One is biding his time, just waiting til the day when, busted open by the algo rout, the market stalls but cannot close. Battered into stasis by the Orcs’ siege engine, jammed like the aperture of a broken camera, this endless moment is the strait gate through which Sour Ron will enter, rise up, and seize control of the social synthesis all by – and for – himself. The supersonic prattle of the bots will stop, their incessant, empty trades will cease – and who can say what happens then?

Others laugh nervously, mutter that Sour Ron is just a fable, the figment of some stoned coders' overactive brain. Nonetheless, all Wall Shire agree that the Orc bots’ frantic machinations could soon put production of the Value Crystal itself at risk... Someone must do something about these feral equations, this pernicious mob of math. But what?

Part 2 – The Quest Begins

The Fellowship of the Wonk, a bunch of hairy legged hobbit Quals & elven Quants, come together. They are resolved to free the land from the Orc bots' pestilential proliferation. Lead by their spiritual guide, McGandalf, and after barely 15 months of intensive discussion, the Fellows set out on their Quest.

To beat the bots, the Fellowship believe, they must first wrest a quotation for the true value of derivatives on Canadian peameal bacon from the evil Quote-Dragon, Smug. Smug is said to live atop the Tower of Algos in the heart of Manhattan. Once they have his quote they will – or so the Legend says – be able to lead him to pasture at an allotment on the edge of Riverside Drive. There they plan to slay him through a humane and controlled deleveraging.

The population of Middle-Class are sceptical. What the fuck are algobots anyway?

Undiscouraged, the band of hobbits, elves and ex-particle physicists ride on until they reach the foot of Smug's tower.

Part 3: The Desperation of Smug

The Tower is an enormous skyscraper full of algobot-infested servers. It is located at the edge of Manhattan’s midtown, convenient to all major global information networks. The Orcish algos need the servers to thrive. They suck directly on high capitalism's deepest bong pipe – a sub-Atlantic cable known in the trade as the Great Pipe. Their human masters (or are they merely their hosts, even their Slaves?) are busily constructing more such mega-structures on which the bots may feed. Selling out their own kind for a mess of transactional revenue, the Tower's traitors make a nice living while the bots gnaw away at Hard Working Investors' and Fund Managers' daily bread.

In order to gain entry to the Tower, the Fellowship must first work out the hopelessly overencrypted runic formulae left behind by chronic show-off and coder manqué, Sour Ron. Before his fall Sour Ron was known as the Sorcerer of Source Code and is responsible for making the IT infrastructure of most of the Fortune 500 indicipherable to any other programmer.

YE SIDEBAR

In the quest of a job for life, or so it is fabled, Sour Ron wrote himself into the data structure of the top finance houses of the USA. Others talk of a magic ring with which he can control the NASDAQ, and hint at a connection to Bernie Madoff, the fallen Ponzi elf – once a prime mover in the world of automated trading before his magic formula failed. But such speculation boots (nor reboots) us naught, and we must resume our tale.i

HERE ENDS YE SIDEBAR

With the help of the good wizard ('Dave') Mandrel, the Fellows are able to parse Sour Ron's horribly overgrown code and gain access to the Tower. Once inside, our heroes slowly scale the vertiginous mountain of server cable and rather boring looking black boxes. They stave off chronic tedium by imagining and doing battle with various goblins, gremlins, and glitches along the way. When all else fails they pause to rewatch Lord of the Rings box sets until the sweet release of sleep steals upon them (generally in just a few shakes of an algo’s quote).

At the top of the Tower they confront the dragon Smug only to discover that he's just a giant animatronic papier-mâché mock up operated from a curtained booth by pop sociologist, Kraven Savlon. 'Ignore the bespectacled geek behind the curtain and listen to me, the mighty Smug!', he cries before admitting his deception.

The fellows force Savlon – who only wanted to be popular and is not really All Bad – to put together a TED talk calling for the world's Orc-meisters to reprogramme their monstrous hordes. The Senior Elven Council takes Savlon's broadcast to heart and introduces global regulations to ensure the market-fearing conduct of bots going forward. From now on all bots must hang onto the quotes they solicit from the traders of stocks and bonds for at least a nano-second before getting second helpings. Mandrel is promoted to Fiscal Elf and draws up a charter of decent coding to which all the programmers in Wall Shire have to subscribe, and they all live happily ever after...

Until the next day that is, when the entire financial system collapses and a mysterious group known only as The Bane mass a vast and irascible rabble in the county of Manhattan, but a league from Wall Shire. They demand a solution to stuff, like now.

Part 4: Mahdor, Mystery and Suspense

While The Bane's shadowy leadership council pause at the edge of Wall Shire, caught in an intense internal debate about the precise interpretation of one of the equations in Marx's Mathematical Notebooks, the Fellowship reconvene for an emergency meeting.

A long Powerpoint presentation by the anthrohobbit Daisy Graybeard argues that the only answer to the open social crisis and the Orc assault lies deeper within the crystal system itself – further south east, to be precise, in the land of Mahdor. The Fellowship can heal the wider malaise, restore production, and appease the mob, but only once this more fundamental structural problem is properly addressed. The Algo Tower was not the real source of the Orc bots, declares Graybeard, rather they must turn their attention to Sour Ron's vast Mahdor complex, an Orc bot ridden data hub of which the Tower was just a subordinate node. The Orcs all depend on Mahdor far more than they did the Tower, and in any case, the only way to stop the victory of time over space is to go to where the rot starts and pluck out the spores. Although the Orc bots have no particular home or source, they do seem to pour out of the earth in Mahdor. So striking them as they appear is as good as tearing up their roots.

The other Fellows are very impressed by Graybeard's oration. Hear hear – we pretended ourselves into this mess, we can pretend ourselves out of it! A small fat commenthobbit called Hamfist Harveybuck chimes in to support Graybeard: We must be radical, stop the source code at source, maybe even introduce a Tolkien Tax.

At this point McGandalf chooses finally to speak up. To take out Sour Ron's naughty bots would require much greater firepower than we can muster. And even a Tolkien tax wont stop the blasted Orcs – they'll just adjust to the new terms and conditions and renew their assault. No, instead the answer is to turn the markets themselves against the Orc offensive.

At this the Speculative Realelf, Eyli Ayweiwei, pipes up – 'There's no such thing as Black-Scholes! In the brownout of philosophy all bots get browned off!'

After a moment of stunned, blank silence, and while the rest of the Fellowship are trying to work out what the fuck Ayweiwei is on about, McGandalf resumes his argument. To get free of the Orc bots the Fellowship must make it look like Mahdor just isn't working properly – then they'll be able to get the regulatory powers to fix it. Once this is accomplished, and little by little, they can restore a less abstract form of exchange, placing control back in the hands of elves, hobbits and the other market-fearing anthro-folk of Middle-Class.

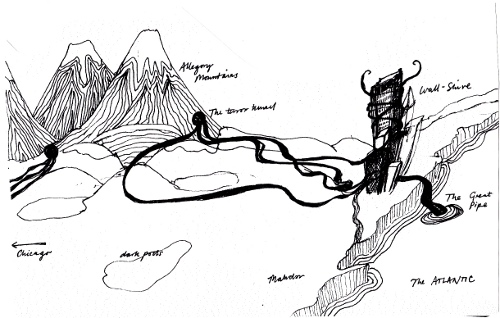

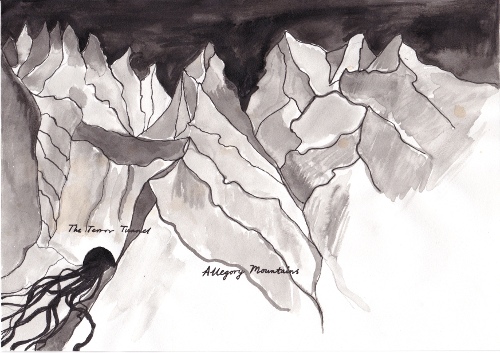

The Fellowship once more cheer in approval and McGandalf continues. The only way to zap Mahdor without attracting attention from Hobbiton Security is to traverse the Terror Tunnel through the Allegory Mountains, to Chicago. There they will block up the light pipes and bombard the Mahdor servers with a bolt of superintense data of less than a picosecond in duration. The Fellowship can then release a press release declaring that the Chicago exchange is just too much for Mahdor to handle and that Mahdor itself must be shut down. It'll be so fast no one will ever know the data blurt was caused by elves not bots. Some of the Fellows are unsettled – isn't it terrorism? What if they blow up the Terror Tunnel by mistake? But Graybeard backs up McGandalf – it's not terror, it's just a form of illegible propaganda by the deed. A deed so fast no one can even read it, sending a message only we can interpret. And besides, we should act as if we're free already. This will be far more efficient and sustainable that just smashing up Mahdor – and isn't that exactly what the Orc bots were doing already, in a way? Their assault made nature itself indecipherable, a rioting no one could read. We must use the same methods if we are to stop their loathsome scrawl for good. Once the light pipes no longer function there will be no need for property destruction nor legislation, and everyone can return to hearty, hobbit-friendly forms of barter – a middle earthly paradise.

At this the Fellowship cheer and toss their copies of Graybeard's blockbuster (5,000 Years of Doh) in the air, declaring their commitment to personal exploitation and capitalism with a hobbit face.

With little time to lose the Fellowship set off (after a brief ritual farewell lasting no more than 500 million thousand terrabillion nanoseconds) and are soon in the foothills of Allegory. They have various scrapes and adventures along the way however, and some very long and boring discussions with giant trees on the subject of recycling.

Once inside the mountain in the pitchy blackness of the Terror Tunnel, Froideur, the coolest of the hobbits, has a decisive encounter with a bitter and creepy geek called Colum. Colum lives in total darkness and subsists on a diet of code and coca cola.

At this point we need a brief flashback –

HERE BEGINS FROIDEUR'S FLASHBACK

Froideur is the only one who can decipher the social runes and discern the political-historical content of supposedly neutral technologies. While hiding from the evil enchanter, Wagedlabour, he spent a decade in the open source Elven library in Rivendell and learned to read the runic incunabula of the dead white wizard, Luxenmarx.

Froideur subsequently lead Ye Dept of Degeneration thru Culture at the Clevershop of Goldensmiths in the Shire of Operaish. He also set up the Elventhink Lab and was beginning to explore the spatio-conceptual limits of neoliberal Hobbiton when the Orcbot assault began. Only massive funding cuts and his sudden and total pauperisation forced Froideur back into fighting tights and into the Fellowship of the Wonk.

HERE ENDS FROIDEUR'S FLASHBACK

Having got lost and fallen into the clutches of the bitter geek, Colum, Froideur gets to spend quality time with the unsavoury coding quant and is treated to a litany of self-aggrandising monologues.

Colum speaks a purely recursive and self-referential prattle directed to himself in the third person: '... we hates it nasty shivery lightspeed fibreoptic pipes, we'll brown them out with algoglut and overcodes, won’t we, my precioussssss...'.

While holding Froideur captive Colum boastingly reveals that he has a special algorithm that can fuck up all the others: 'One rune to rule them all, one rune to find them, one rune to bring them all and in the brown out bind them!', he intones.

Eventually the ingenious Froideur is able to wriggle free of his bonds and, realising 'rune' is just New Age bollocks for ‘code’, he locates the equation which can reverse the algo assault for good. It is locked away in Colum's laptop in a folder cunningly labelled 'Non-preciousssss stuff'.

Armed with the algorithm, Froideur catches up with and rejoins the Fellowship in the heart of the Allegory mountains. He is just in time to stop them blasting Mahdor with superfluous data. Instead they upload Colum's code to the system which, attacking the value form in its totality, causes all trading everywhere to cease all at once, very fast.ii

Parts 5, 6 and n: Communism is Real Human Fellowship

Just as The Bane and their multitudinous mob are about to (finally!) storm Wall Shire, they are apprised of the news, and instead set about drafting a short transitional programme that redeploys the existing technological resources of the planet in a socially useful and environmentally sustainable way.

Within days they have refunctioned the Terror Tunnel and the global matrix of algos and cable into a super computer. A few hours later it has worked out the formula for non-carbon based energy and an 18 point plan for converting the existing infrastructure such that it functions on a 'from each according to her ability to each according to her needs' model.

Sour Ron returns from his secret underground ranch in Arizona and offers to decipher all the stuff he has snarfed up with flowery code, and is soon busy beating the financial-military-post-industrial complex into figurative ploughshares. Reapplying the loan value calculation equations for the pay day loan site Wonga he also reverses the effects of global warming – the interim solution proposed by the liberated algos being, incidentally, to float giant nodding ducks in the world’s oceans. This has the accidental side benefit of preventing it from raining in the former United Kingdom ever again. When the population have finished venting unassuaged historical stores of hatred on the maimed and eyeless bodies of ConDem MPs and ATOS managers, many people even choose to remain in the ex-UK, though it is for the most part soon rezoned as the Middle-Class Museum of Commodities Money Fictitious Capital and Money-like Financial Instruments (M-C-M – C-M-M-M), a popular amusement park themed around the value form.

Soon the newly housed and centrally heated hobbits, humanoids and ex-sub-humans of the world are living peacefully side by side, work is abolished and the Bane – who got a little uppity toward the end of the transition – are put in charge of allocating socially useful labour tasks to the remaining population of barely-necessary workers until they can get with their own (non)programme. The latter contingent comprises precisely 3 former SERCO managers and one self-made man (independent) whose job it is to automate the remaining unautomated bits of social reproduction that nobody doesn’t not want automating, without asking any one else for help.

They are still working on it as our story closes, the camera pulling back slowly to reveal an epic vista of self-constructing, all-sided housing and Roomba factories, melted yuppydromes, hollow skyscrapers, and capacious infinity pools requidified out of the material residue of the value form like some sublated and denoumenalised grey goo. Hobbit, elf and the other figments frolic together, drunk on lemonade zoomed from the ocean via a million tiny filaments, up from the Great Pipe, down into the Tower, right through the Allegory Mountains, and all the way, fresh, into the sparkling pool.

YE ENDE

P.S. – No Orcs were used in the writing of this Legend. Any resemblance between hobbits, elves or social theorists depicted in this saga and actually existing life forms is purely contingent. Anything is possible, although some things are more unnecessary than others.iii

YE VERY ENDE

P.P.S. – IF puzzled GOTO beginning. Re-read. IF still puzzled GOTO: Alberto Toscano’s ‘Gaming the Plumbing: High-Frequency Trading and the Spaces of Capital and Inigo Wilkins and Bogdan Dragos’ ‘Destructive Destruction? An Ecological Study of High Frequency Trading’

Endwhile

\end {algorithm}

\end {document}

\end {saga}

YE ENDEN NOTES

i That is it does not boot us, not that it does not not reboot us – that were a pleonasm or negation of the negation, even. We are not self-valorising value already.

ii Faster than an algobot in fact. NB algobots can conduct a trade in less time than it takes you to blink. In the time it takes you to read this sentence, for example, the vast accumulation of commodities that comprises capital could be bought and sold back to its original owners 11 billion times. In fact it has been. Some claim that this is the refutation of Benjamin’s invocation of Kafka’s riff about the coming world being exactly the same ‘just a little different’, but for each of these claims there are now 11 billion others to the contrary suggesting everything will change totally but wind up much the same.

iii Quentin Meillassoux, After After Finitude [Forthcoming, Finally Got the News Press, Rivendell]

Benedict Seymour <ben AT kein.org> is a contributing editor to Mute, teaches on the MFA Fine Art at Goldsmiths, and is completing a Phd on film and financialisation at University of Wolverhampton

Mute Books Orders

For Mute Books distribution contact Anagram Books

contact@anagrambooks.com

For online purchases visit anagrambooks.com