Trading Futures, Consolidating Student Debt

With a mass default on US student debt threatening to create the next subprime crisis, Angela Mitropoulos dissects the pious injunction to ‘live within ones means', reminding us that to do so has always implied the back-breaking, often immeasurable work of others.

In the United States, student debt has outstripped credit card debt, nervously edging toward the one trillion dollar mark and tracked by escalating commentary, protest and defaults. Indeed, student debt has surfaced as one of the abiding themes of #occupy in recent months, foregrounding the already systemic alignment of those protests with university occupations, the anti-austerity campaigns in Europe, campaigns against foreclosures resulting from the collapse of the subprime housing market in the US which, it might be added, emerged a decade or so after the debt-elicited Structural Adjustment Programmes that spurred the anti-summit protests.

Facing one of the highest rates of unemployment in recent times, an unprecedented two thirds of 2010 graduates in the US held debts above the $25,000 mark. Moreover, the number of graduates carrying debt from the more Draconian private loans schemes leapt from just over 930,000 in 2003-04 to slightly under 3 million in 2007-08, and (leaving aside federal loans) is currently estimated at around six billion dollars. Pointing, as it does, to the possibility of large scale default, the growing gap between student debt and (potential) income is not only the financialised trace of conflicts over the expansion of contingent labour, of sharply declining wages and access to welfare, and of an increasingly privatised, costly education system. It is also the signal of the deeply racialised appearance of subprime loans schemes which are adjudicated by variable interest rates and unprecedented limits on the discharging of debts.

To be sure, debt became the means of deferring declining incomes and, particularly in the case of recent student debt, the source of brief respites from - or hopes of escaping - increasingly precarious work. As education was privatised and tuition costs rose by six hundred per cent from 1980 (in the main to provision corporate managements and real estate value), by 2007 a thriving (and, it might be added, prescient) private loans industry was furnished with legislation that made it impossible to discharge debts through recourse to bankruptcy. Tightening restrictions on the bankruptcy provisions of student loans that began - perhaps unsurprising - in 1978, student debt is situated in the exceptional legal zone of debts accrued through fraud or crime. More recently, while President Obama promised debt relief, he excluded the private loan sector. Though its profits remain enormous, its earnings have fallen in recent times between 10 and 40 percent depending on the company, and so the private loan industry continues to spend heavily on political lobbying to stem further decline by ensuring the constant renegotiation of unbreakable contracts. While the greater proportion of loans remain federally-funded and guaranteed, the biggest increase in student debt has been in the subprime market. That is, private loans for smaller initial debts bearing more onerous conditions: over half of such loans are for attendance at institutions charging less than $10,000; they have few, if any, provisions for hardship; interest rates are not fixed, and they are almost impossible to discharge. That the expansion of student debt has been a lever for the increasing enrolment of poorer students is indicated by the rise in the numbers of African-American undergraduates taking out private loans, quadrupling between 2003-04 and 2007-08. Some of this went to supplementing insufficient federal loans, a further index of rising costs and declining incomes.

Rates of default, late payment and evasion continue to climb and are predicted to worsen. An estimated 50 billion dollars worth of federal loans are already in default. And, as with the subprime housing market, there are those who would denounce not the injunction to repay what could have been made available, but the fleeting avoidance of austerity in increasingly cramped conditions. There is talk of a speculative ‘bubble' in education, in readiness for a bust. Speculation, it seems, is the prerogative of Wall Street. As is debt, since it should go without saying that stock exchanges are involved in raising money for corporate use in the form of shares. Bailouts perform a similar function. For everyone else, debt and speculation remain morally suspect, the chance of deferring the settling of accounts and determinations of value, a dangerous break in the logic of commensurability, representation and right that ostensibly links income and labour, yet construes surplus labour as a type of indebtedness. That is to say, workers are assumed to owe employers more work than is reckoned necessary for their own renewal. This transactional modification of the sentimentalised, unmeasured ways in which domestic labour is often rendered as obligation, and that slaves were considered to be fugitives until they performed the labour regarded as due their masters,i continues to be understood as a variant of indebtedness. In its increasingly precarious forms, that indebtedness troubles the boundaries of recognition and recompense that apparently connect the wage to the ‘normal working day', returning us to the question of the allocation of the surplus rather than the assignment of right.

So, while these figures surrounding student debt are striking, they detail the larger questions campaigns against debt have to confront. Debt is, above all, the reach for a future that might be other than the present, or just a bit better. These student debts are contractual projections of financial obligation into the prospective time of the future. They forge intense links by way of interest rates, repayments and rescheduling between the speculative present and a calculable tomorrow. Yet it is in this distance, however fine, between speculation and calculation, between the bold gambling on possibilities and the settling of accounts, or between immeasurable uncertainty and calculable risk, that capitalist futurity becomes recomposed less as an inexorable necessity than a question of whether and how the restoration of austerity might proceed.

Generalised indebtedness holds open possibilities. If debt has become the prominent motif of protests around the world, this is not to suggest that all critiques of debt are anti-capitalist. Or, this is not to imply that all opposition to debt is concerned with the interlocking questions of debt, right and recognition that, for centuries, have made unpaid labour (whether as surplus labour or without pay at all) appear as a more or less naturalised form of indebtedness to capitalists. In other words, insofar as the expansion of debt marks a crisis of social reproduction (financially expressed as a gap between income and expenditure, but nevertheless articulated as a brazen reaching beyond the austerities obliged by this decreasing income), the political question to be posed of various critiques of debt is of the extent of their opposition to (or complicity with) the re-imposition of the injunction: ‘live within one's means'.

Do denunciations of debt servitude imply a critique of the indentured labour that debt obliges or do they merely demand its reallocation according to the seemingly natural lines of race, gender and class? Debt includes a salient instance of speculation (however cynical, foolhardy or prudent) that for conservative critics should only be the prerogative of those who can command the labour of others. Debt is legitimated by its connection to productivity. If debt is not to result in a diminution of income during repayment, it presumes a rising income. Either labour is extended, intensified or acquired from others. This, crudely, is the formula of capital. It is also the logic of investment in human capital that, as it turns out, must be outfitted with moral and legal limits in the form of the unbreakable contracts of student debt, lest the sequestered surplus of capital be misconstrued as general abundance.

Of course, these dynamics have a much longer history than that of recent student debt in the US. Before the much touted turn to neoliberalism in the US, the UK and elsewhere, with their increasingly privatised schema of social reproduction (education, welfare, housing, health care and so on) and the expansion of personal and household debt that this precipitated, the Keynesian welfare state that emerged in the wake of the Second World War was premised on deficit spending. That debt was underwritten by the below-the-line labour in the colonies, by former slaves faring a little better than before, recent migrants and unpaid domestic work. It was guaranteed by imperial force, the credibility of the US dollar as the de facto global currency and that combination of racism, sexism and nationalism that makes below-the-line labour appear natural or obligatory.

But the second half of the 20th century was also the history of the civil rights movement, second wave feminism and struggles around unpaid domestic work, the unprecedented reversal of colonial flows, the emergence of migrant workers' movements and more. In this, the boundaries that had limited the demands on the Keynesian state to the family wage claims of citizens gave way to fiscal crisis, switching the displacement of debt from the geographic, racialised and gendered architectures of Fordism to those of post-Fordism. This, in turn, entailed the spread of contingent labour, the relocation of debt from the state to households, and an emphasis on human capital formation. The post-Fordist financialisation of daily life, the indistinction between the time of work and that of life ushered in by the expansion of precarious work, and the personalisation of debt are, in this regard, less a signal of the appearance of a new epoch than of the collapse of the Fordist compromise between sections of the working class and capital in the wake of its challenge by those who were not deemed to be parties to the deal, but nevertheless made it possible.

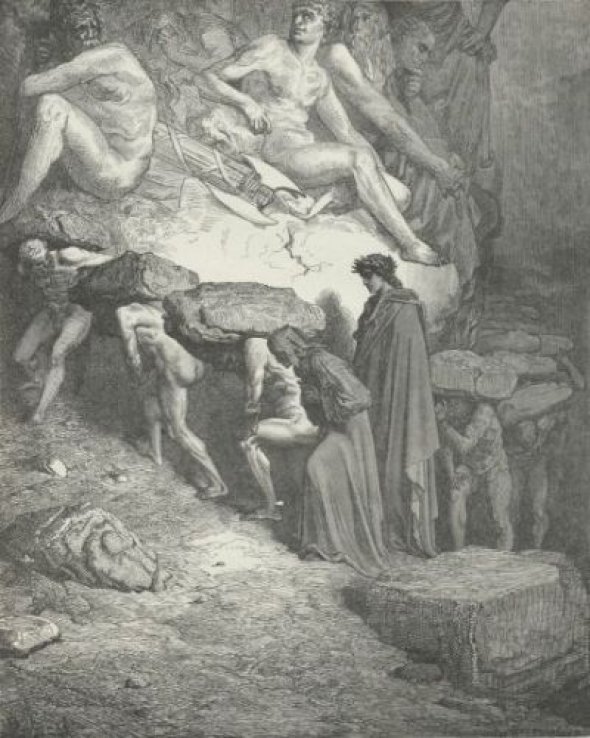

If all this raises the question of just who is indebted to whom, it might also trouble the moral injunction against debt, reanimated during times of crisis, that was written into the historically pivotal pact between ecclesiastical authorities and merchant capitalists at capitalism's inauguration. Threatened by the anti-feudal struggles, the Scholastics turned to Aristotle to both enable speculation and limit it to its specifically capitalist (i.e., re-/productive) forms. In their insistences that income should only be accumulated by labour, just as sex should only be for the purpose of women going into labour, the Scholastic tirades against debt were always intended for the lower classes. Surplus was, is, reserved for capitalists. Church prohibitions against usury were invented at around the same time as purgatory and the introduction of indulgences. Just as sermons against gambling, sex and excessive pleasure reached a crescendo in the Middle Ages, the Church invented the space of purgatory situated between heaven and hell where one could pay off one's debts, and it fabricated the means by which one could literally buy one's way into heaven with a donation. These apparently anti-capitalist decrees, with significant caveats for capitalists themselves, remain the hallmark of conservative critiques of debt. They are the Middle Ages version of lobbying and bailout. Moreover, the current resort to the unbreakable contract (the neo-contractualism of welfare, student debt and more) returns to early forms of contract as it emerged from theological understandings of covenant: absolutely binding, transcendental and infinite. For conservatives today, the expansion of debt is a problem because the crisis of reproduction it signals can, with widespread default, segue into a crisis of capitalist futurity more generally.

Unpaid debt, very simply put, holds out the possibility of ‘living beyond one's means' when the means of re-/production are no longer in one's easy reach. The revival of Aristotelianism at the very moment of its historical obsolescence during capitalism's rise - something a little more complex than what Marx nevertheless grasped through his insight into the historically momentous separation of the worker from the means of production - marks a persistent feature of attempts to reimpose the demarcations that makes capitalism what it is. If the Scholastics borrowed Aristotle's understanding of language, with its stress on commensurability and representation, at a time when value had become speculative and uncertain, the recourse to an Aristotelian distinction between politics and economics today indicates a similarly anachronistic move in far from critical understandings of the conditions of capitalism. Aristotelian equality, as Marx notes, cannot conceive a specifically capitalist equivalence, the commensurability of the qualitatively incommensurate, just as (I would add) his realist theory of language has difficulty admitting the future-contingent that defines the contractual, and his understanding of logical axioms can only assume the representation of natural rather than contingent value.

As fleeting as Marx's remarks on Aristotle were, he nevertheless noted that this limit to Aristotle's thinking relates to the situation of slavery in ancient times. In other words, the neo-Aristotelian emphasis on a repartitioning of politics and economics - more or less explicit in the arguments of Polanyi, Foucault and Arendt, as well as in calls for a return to ‘real democracy' - rely on a crucial fudging. For Aristotle, the egalitarianism between free men in the polis (city) was necessarily predicated on the slavery that was relegated to the oikos (household). Leaving aside the question of whether the logic of democracy partakes of the sense of capitalist equivalence rather than equality as Aristotle could have understood it (as with Arendt's idealisation of ancient democracy), the resort to neo-Aristotelianism either romanticises the oikos (as do Polanyi and Foucault), or it sidesteps the decisive question posed by the expansion of debt at this particular time, and as the issue makes an appearance in the occupations.

In doing so, it abandons the critical conjuncture of default and occupation that points not to a revival of democracy (since the models of decision making are not democratic but take their cues from decentralised networking), but instead to experiments with ‘promiscuous infrastructures' that have been ongoing in protest camps for more than a decade, from Seattle to Tahrir and beyond.ii In the seemingly tangential arguments over how to organise the labour that goes in to sustaining the occupations, how to arrange kitchens, energy, medical care, shelter, communications and more, in the correlations between homelessness and the #occupy encampments, in the very question posed of how to take care of each other in conditions of palpable uncertainty, live the pertinent issues of the oikos in these times. It is not surprising, then, that in her discussion of the occupations at the University of California, Amanda Armstrong begins with foreclosures and the transformation of universities into real estate in order to go on to highlight the centrality of ‘bonds of care' to both the protests and the creation of a different kind of university.iii If debt marks a crisis of social reproduction, then the question surely becomes how to generate forms of life beyond its specifically capitalist forms?

The boundary between economics and politics is mutually constitutive. It has been constantly reconfigured not by capitalists but in the process of their pursuit of fugitive slaves from modern sites of oiko-nomics: the flight of women from the home, working class children from the factories their parents laboured in, the middle classes from increasingly precarious labour, the great grandchildren of slaves from the servitude of workfare, migrants from impoverishment and devastation. To dream of returning to a fanciful time of self-sufficiency and independence is to yearn for the conditions that made the subject of politics or the head of the household possible, and so for the reconstruction of the boundaries erected against this flight. Debt made this flight viable, but it is for the most part the debt that might be understood in terms of the irreducible, incalculable inter-dependence of sharing a world if not always a circumstance. As Annie McClanahan put it, the growing calls for mass student default mark a challenge to ‘the temporal logic of indebtedness', the discovery of ‘a present in which our debts are only to one another.'iv

In this sense, the increasingly common predicament of financial debt bondage calls not for the restoration of a common identity as the demos (the fantasy of a return to the putative nobility of politics untainted by slavery); nor for a rallying of the university as an apparently meritorious machinery of credit and value unsullied by the presence of (former) slaves; nor, still, for the re-imposition of what it might mean to ‘live within one's means' for those deprived of the means of life without labouring (not alongside but) for another. It calls instead for the political consolidation of student debt with all the other forms of debt that dare to venture beyond austerity, for the transformation of infinite debt into endless credit, and a break with the capitalist limits on speculation. As the implications of student indebtedness unfold into already-uncertain financial circuitry, or are quarantined by the wall of the unbreakable contract, debt may well serve as the projection of the present into a calculable, foreclosed future. Or, in the congruence of default and occupation, it just might wander beyond the intimate reckonings of human capital's self-imposed imperatives into the creation of infrastructures of another kind of indebtedness and conjecture.

Angela Mitropoulos <s0metim3s AT gmail.com> is presently in Sydney. Her most recent writings are 'Legal, Tender: The Genealogical Economy of Pride, Debt and Origin' (Social Text, 29:3), 'Uncanny Robots and Affective Labour in the Oikonomia (Cultural Studies Review, forthcoming 18:1), and Contract and Contagion (forthcoming) on which much of the above analysis is based.

Footnotes

iOn this last point, see Stephen Best's The Fugitive's Properties: Law and the Poetics of Possession, Chicago: University of Chicago Press, 2004.

iiThe phrase is borrowed from Anna Feigenbaum and the Creative Resistance Research Network's studies of protest camps.

iiiAmanda Armstrong, ‘States of Indebtedness: Care Work in the Struggle against Educational Privatization,' South Atlantic Quarterly 110:2, 2011.

ivAnnie McClanahan, ‘Coming Due: Accounting for Debt, Counting on Crisis', South Atlantic Quarterly 110:2, 544.

Mute Books Orders

For Mute Books distribution contact Anagram Books

contact@anagrambooks.com

For online purchases visit anagrambooks.com