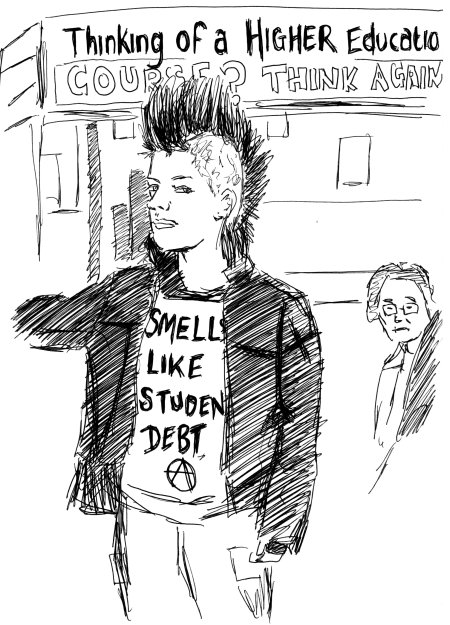

Speculating on Student Debt

Far from being a right, British higher education in the age of top-up fees is a commodity with a hefty price tag attached. For most students, write the Committee for Radical Diplomacy, it offers a basic schooling in debt and recasts learning as a down-payment on a dubious future

I wake up at ten to a call from the bank, concerned that while in Berlin I withdrew cash without letting them know I would be out of the country. A text message follows stating: ‘Next time, let us know so that we can protect your interests.’

Beyond late, I get on my bicycle and pedal frantically to class. I have not had time to do the reading as I spent last night working and was too wired to read the Grundisse when I got home. (I repeat to myself, ‘next time I will read, I will force myself to read. I have no business doing a PhD if I do not force myself to read.’)

In class I nearly fall asleep several times. It’s hot and they are clearing out asbestos from the hallway, but I try to put up my hand a few times to keep the conversation going. It’s hard as the other students are tired too. So is the professor, who tells us she is in the process of ticking a thousand boxes on her AHRC grant application to get a sabbatical.

I hear about four conferences happening in the next week. I can go to none of them. I’m working. One is called ‘Knowledge for Wealth Creation’. I roll my eyes.

Coffee with colleagues. Of course none of us mentions the ‘f’ word (finances). We talk about communes, island fantasies, this week’s private views that none of us can attend and departmental gossip.

Downstairs my students drift in, looking absent minded. I wonder what motivates them, and nearly fall asleep several times. So do they. I wonder if it’s because of parties or because of work, or the asbestos.

Back on the bike.

Stop at the mobile phone place to see if credit check went through for new account. I am informed that I have been declined due to bad rating. No one can tell me who decides how one gets ‘bad rating’ or based on what criteria. But every time you check it gets worse, they say.

In a panic I think to myself, I can’t even get a mobile phone. What will I do with my life? What will I do with my life? What will I do with my life?

Off to an interview for a summer internship gig. This one’s for pay, so I should probably dress up. No time.

At the interview they ask, ‘what do you want to do with your life?’ I give them my packaged answer (enter current ambition for appropriate job here).

Upset by yet another occasion in which I sit in the face of judgment wearing bad shoes, I stop by a café in Mile End for moral support and to say goodbye to friends – more like acquaintances – who are moving to a city with cheaper rent. That’s a lie. I’m really there because they’ve told me a guy I’ve been wanting to meet who knows about a scholarship might stop by. I wait. We talk about making a television program about our lives. Who would buy it? We talk about going out on the razz – ecstasy, a rave – which we’ve never done in all our years as grad students. The guy never shows up.

The age is off its hinges– Derrida

We begin with this short vignette of everyday student life to point out what we already know. We are Generation X, Generation Debt, Generation Fucked. Depends who you ask.

The story of privatising European education can be told as a tale that dates back to 1995, when the WTO brought into effect the progressive liberalisation of trades and services under GATS (the General Agreement on Trade in Services). Through this process education has been designated a vertical sector of the economy, which means that state subsidies for educational institutions may now be considered a hindrance to trade and thus may have to be abolished (or made accessible to foreign providers).

It is most recently under the banner of the Bologna Process that many universities have begun to champion privatisation with renewed gusto. This document, drawn up in 1999 by 29 European countries, set out to standardise higher education across the EU, and liberally deployed the language of ‘inclusion’ and ‘mobility’. But, truth be told, the document itself did not make privatisation mandatory.

In all countries where education has been privatised, there has been an escalation from a gradually intensified demand that individual students contribute to the cost of their schooling, to lifting caps on these costs, to state managed student grants, and finally to the liberalisation of loans. As is often the case, it is the US that is leading the way with the UK following at its heels. (For nightmarish tales from the other side of the ocean see: http://www.generationdebt.org).

Gordon Brown has recently announced that, for the second time in the matrimonial tangle of top up fees and student loans, he intends to sell off the £16 million worth of student loan debt to the private sector. The State is as usual underwriting business by selling off public assets at below market value for short term budgetary gains. The money earned from the sell off will, we are told, be put back into education. The State is also effectively doing the debt collecting for the private sector since the loan repayment will be automatically taken off former students’ salaries along with their National Insurance contributions by the government.

In 1999, the last time the government sold off loan repayments, future revenue streams from student loans, administered through a non-departmental government company (Student Loans Company), they sold to Honours TD – a conglomerate of Deutsche Bank and the National Building Society. We are told by Bill Rammel, Minister of State for Lifelong Learning, Further and Higher Education, that the government received ‘£1 billion for the sale of student loans with a face value of £1.03 billion.’ They have subsequently paid the banks subsidies of between £30,000 and £110,000 per year.[1]

For private companies, says the Financial Times, the purchase of student repayment is attractive, seen as a low risk investment (i.e. a sure thing) that can be used to secure portfolios such as pension schemes.

For those of you who have not had the pleasure of acquiring a student loan in Britain – since 2003 UK students have been eligible, after a complex qualification procedure, to go into debt with the government in order to pay their tuition fees. This version of the Student Loans Programme was introduced at the same time that universities were authorised to raise top-up fees to an upper limit of £3,000. This directly contravened New Labour’s campaign promise, made only two years earlier, not to introduce the top-up fees they had ‘legislated against’.

The average debt load upon graduation is currently rated at £12,500, distributed between government student loans, bank overdrafts and parental support. Gordon Brown’s elaborate laundering of student debt is in reality a rather basic slight of hand: ‘short term gain at the cost of future earnings’. Like the concept of education itself, the debt becomes a promise of the future in the present. Sold. In this cheap magician’s trick, education mutates from a right (secured through taxation) to a privilege (one you must pay for).‘Unreal’ Living: Blasé Economics

As we are inducted into the ranks of student debtors, a percentage of our future earnings already sold to the highest bidder, we ask the question, why are the conditions of debt so hard to register? Perhaps it is because we just don’t get it. And maybe we don’t get it because, in the words of 1980s valley girls, debt is ‘totally unreal’.

Debt is something that you don’t smell, you don’t touch and you don’t feel. Your student loans go directly from the government to the university account. It is a bit like smoking: pleasure now and pain later – well, perhaps.

In a Parliamentary speech made by Phil Willis on the state of financial education, he reported on what he considers to be alarming rates of public ignorance on the subject. At a moment in which $1.3 trillion had been incurred in consumer debt (a figure above the entire GDP for Britain), 79 percent of people did not know what APR stands for, 20 percent did not understand the concept of inflation and a hilarious 50 percent did not know what ‘50 percent’ means.[2]

This intangibility is a structural dimension of the contemporary global financial system – a system that was actually born with us, the same generation that experienced student debt for the first time. It was 1971 when the USA first ‘temporarily’ suspended the convertibility of the dollar into gold. Until that point convertibility guaranteed the value of the dollar as global reserve currency. Today, we are left with a reserve currency backed not by gold but by (American) debt. How do we pay debts if we no longer have ‘real’ money, i.e. connected to goods? According to Luca Fantacci, we simply don’t.[3] Where international commerce grew from $2000 billion worth of transactions in 1986 to $7000 billion in 2003, international financial markets in the same period jumped from $40,000 billion dollars to $800,000 billion. This means there is currently an approximate ratio of 1:100 between exchanges of concrete goods and services and exchanges of, well, money. Money is traded against other money in a spiraling, self-referential game that confounds wealth with its autistic signifier. This alchemist’s trick, however, has real consequences as it acts as a mechanism for the (re)distribution of wealth, moving value produced by those at the bottom of the financial pyramid into the hands of those at the top.

So, education is becoming a privilege. But it would be simplistic to respond by advocating state education. Our entry into the system of global finance via student debt simply confirms what Ivan Illich has always said about the function of organised schooling (as opposed to education), that it is our induction into wage relations, its hidden curriculum a rehearsal of roles in the productive chain. As Michael Aglietta has argued in his Theory of Capitalist Regulation, debt rests on this division of labour. While in training, we are learning to be in debt, and that being in debt means participating in the current composition of work.

For those able to attend university, the mode of production begins to mirror the speculative operations of global finance. Like theorist Paolo Virno’s service sector virtuosi, student/workers endlessly perform their self-publicity, legions of Nathan Barley-esque ‘self-facilitating media nodes’ betting that frantic networking now will pay off in the future. In this exhausting dance of likeability, only the moderately dissociated (and heavily trust-funded) can survive. And in the differential admission game played by universities, the hot product offered to the student/consumer is precisely the possibility of access to this or that hyped network: the dangling carrot of the internship scheme.

Who Do You Want to Be Today? On Debt’s Affect

Where debt for education is an incredibly effective technology of governance, in the Foucauldian sense, the affective condition of experiencing education as a privilege rather than a right can be framed in a Nietzschean way: the debtor is in a perpetual state of guilt, and the creditor is authorised to enjoy the cruelty of the punishment.

Debt produces us in a strange temporality. It strings us along. Being in debt gives us a sense of linear time, that we are making an investment in our future, that our future will compensate us proportionately.

The tense of education has taken a grammatical leap – from the utterances of the present continuous (I am studying, I am paying off my debt), to the future perfect (I will have prepared myself for full time employment. I will have paid my debt by the time I am 40). The future now.

Students, particularly those entering into the illusory promised land of the creative industries, currently experience this temporal mash up first hand. Their education does not entitle them to a future of full time waged employment. Rather the organisational make up of student life – a combination of paid employment in the service sector, unpaid or highly flexible work in the creative sector, bank overdrafts, government loans and ongoing educational initiatives – is likely to extend well beyond the years of formal education. Graduation marks only the additional burden of debt repayment.

This creates a class of cheap and uninterested labourers that do not have identitarian or affective investments in their paid positions and won’t therefore try to unionise or complain. This condition, which has often been the historical experience of the working classes, is now extended to the middle classes. Among their ranks can be heard a splitting in such vernacular assertions of the relationship between free labour and waged employment as: ‘my real work’ and ‘the work I do for money’.

Organising in the Red? (Because You’re Worth It)

As education becomes organised around increasing levels of complexity, and working life around ever more parceled-out units of time, filled with simpler and more repetitive tasks, we are left wondering what exactly is the privilege that we purchase with student debt? Is it the opportunity to stay out of the boredom and cruelty of the working life for a bit longer?

If we were to imagine organising from the guilt, despair and panic of being in the red, perhaps we may have to start from scratch, by reformulating our desires regarding education and our expectations regarding our working and not working lives.

As Ivan Illich proposed in The Right To Useful Unemployment, we should seek to attain a different kind of subsistence:

The inverse of professionally certified lack, need, and poverty is modern subsistence … the style of life that prevails in a post-industrial economy in which people have succeeded in reducing their market dependence, and have done so by protecting – by political means – a social infrastructure in which techniques and tools are used primarily to generate use-values that are unmeasured and unmeasurable by professional need-makers.[4]

Let’s take it from there.

FOOTNOTES

[1] Taken from a ‘Written Answer’ in response to Alan Simpson MP’s question on 3 May, 2007. Available from http://www.theyworkforyou.com.

[2] APR means Annual Percentage Rate, an expression of the effective interest rate that will be paid on a loan, taking into account one-time fees and standardising the way the rate is expressed, i.e. the total cost of credit to the consumer, expressed as an annual percentage of the amount of credit granted.

[3] See Luca Fantacci, Moneta: Storia di Una Istitutione Mancata, Marsilio, 2005.

[4] Ivan Illich, The Right to Useful Unemployment, Marion Boyars, London, 1978

Valeria Graziano and Janna Graham <radicaldiplomacy AT kein.org> are founding members of the Committee for Radical Diplomacy. Last autumn, together with Susan Kelly, they undertook a lay research project in cities across Europe, dispatching the question ‘what can we learn from free labour?’ from the back of a camper van. They are currently working with a group of students and cultural workers to develop a secret society for interns and other free labourers in London’s cultural sector. Both are Ph.D. candidates and teachers at Goldsmith’s University

Mute Books Orders

For Mute Books distribution contact Anagram Books

contact@anagrambooks.com

For online purchases visit anagrambooks.com